pa inheritance tax exemption

In order to determine the amount due under the PA Inheritance Tax a Personal Representative must ascertain the value of the decedents assets as of the date of death. You can fill out the online application or print one of the.

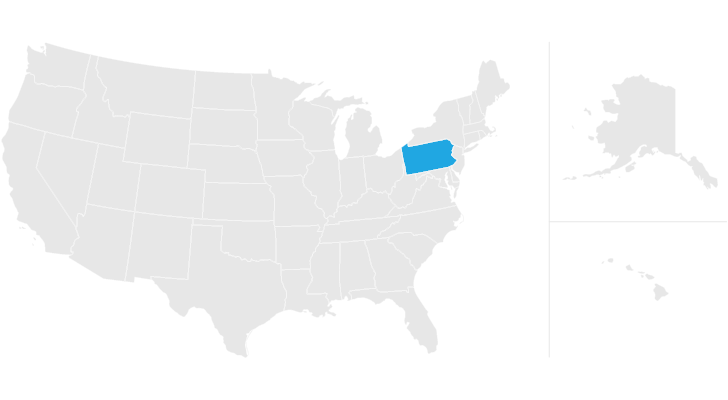

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Estate expenses funeral and burial costs probate fees attorneys fees and the family exemption are just some of the potential deductions.

. The percentage paid depends on the relationship between the heir and the decedent. Family Exemption When a surviving spouse or child or parent of the same household of the deceased claims a vehicle as the whole or part of the family exemption under Section 3121 of the Probate Estates and Fiduciaries Code 20 PS CS. Pennsylvania Inheritance Tax Safe Deposit Boxes Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will or intestacy.

The tax rates and thresholds vary based on the class of heir to whom the property is transferred. The Pennsylvania Inheritance Tax is a Transfer Tax. Pennsylvania Inheritance and Realty Transfer Tax Bureau of Individual Taxes released the 2021 Common Level Ratio Real Estate Valuation Factors for documents dated from July 1 2021 to June 30 2022.

The realty transfer tax is 2 percent. It is different from the other taxes which you might pay regularly. Also if you were to need Medicaid at any time before you died Medicaid might put a lien on the property and the property might need to be sold after your death to repay Medicaid.

The tax rate varies depending on the relationship of the heir to the decedent. A legal document is drawn and signed by the heir waiving rights to. To record with an exemption use a Realty Statement of Value.

Client Review I worked for Peter Klenk for 4 wonderful years. Pennsylvania Inheritance Tax and Gift Tax. Once the estate is valued and deductions are taken the Personal.

Inheritance taxes also known as succession taxes apply to the taxable value of property left to heirs. See all popular answers. There is a 45 tax applied to transfers to direct descendants and.

In the United Kingdom the Windfall Tax was a tax levied on privatised utility companies. Provided that after the transfer the family-owned business interest continues to be owned by a qualified. This means as a couple you are paying Income Tax on 7430.

Everyone truly cares about their clients and has a strong sense of responsibility to get things done right. Fact Sheet found on our website at wwwdmvpagov. For example the following types of real estate used to do the following activities are not exempt.

An inheritance tax return must be filed for every decedent or person who died with property that may be subject to PA inheritance tax. Pennsylvania inheritance tax does not provide an exemption for certain types of real estate. I cant speak highly enough of everyone at the firm.

Once we accept your Homestead application you never have to reapply unless your deed changes. As of July 1 2021 the Common Level Ratio Factor for Montgomery County is. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

The Act was intended to recoup the revenue earned by oil. It saves most homeowners around 629 each year. Wwwrevenuepagov CONTACT INFORMATION For additional inheritance tax or safe deposit box information please call 717.

The Register of Wills accepts inheritance tax returns and payments on behalf of the Pennsylvania PA Department of Revenue. After nine months the. The Homestead Exemption reduces the taxable portion of your property assessment by 45000 if you own a home in Philadelphia and use it as your primary residence.

In United States tax law there is a distinction between an estate tax and an inheritance tax. Effective July 1 2013 a small business exemption from inheritance tax is available for a transfer of a qualified family-owned business interest to one or more qualified transferees or to a trust for the sole benefit of members of the same family of the decedent. 3121 shehe may assign the title to the new owner.

How do I unlock andor reset my password to my e-Signature account e-TIDESPA-100. Though there is no estate tax there is an inheritance tax in Pennsylvania. The tax is due within nine months of the decedents death.

No tax is applied to transfers to a surviving spouse or to a parent from a child under the age of 21. Your partners income is 20000 and their Personal Allowance is 12570 so they pay tax on 7430 their taxable income. Some states have a smaller estate tax exemption than the federal exemption so leaving the property in your estate may cause your estate to owe the state taxes.

Recreational activities like hunting fishing camping skiing show competition or racing Raising breeding or training of game animals or game birds fish cats dogs or pets or animals. In 1980 the United States enacted the Crude Oil Windfall Profit Tax Act PL. The former taxes the personal representatives of the deceased while the latter taxes the beneficiaries of the estate.

Inheritance tax estate tax and death tax or duty are the names given to various taxes that arise on the death of an individual. Lineal heirs eg children grandchildren and parents are typically taxed at lower rates than distant relatives or unrelated heirs. 96-223 as part of a compromise between the Carter Administration and the Congress over the decontrol of crude oil prices.

How do I complete Section 02 of the PA-100 if I am an out-of-state or foreign business. Free Consultations 215-790-1095 Δ. The heirs themselves are liable for the.

Three Estate Planning Strategies For 2021 Putnam Investments

How Do Millionaires And Billionaires Avoid Estate Taxes

Pin By Diane Dries Realtor Artist On Web Guide Home Buyers Estate Tax Tax Exemption Home Buying Process

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Inheritance Tax What It Is And What You Need To Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Tax Return In 2022 Tax Brackets Standard Deduction Estate Tax

What Is A Homestead Exemption And How Does It Work Lendingtree

Ebay Will Collect Sales Tax In 5 More States Sales Tax Marketing Communication States